Hello again. It's been a while since my last post.

I'd like to touch on minimizing risk this time. It's interesting how a company like LLEN can look promising at first and then things go sideways. Of course there is always risk when trading equities but there are ways to reduce risk. Thankfully I only had a small position in this company that is now being charged by the SEC.

There are the typical portfolio theory ways of doing so. However, I would propose that there are more interesting options for the growth seeking investor.

So, picking stocks and trying to reduce correlation is a good option. However, there are also some great ETFs out there.

Regarding particular ETFs, I'd rather not recommend individual ones. However, there are some that emulate indicies, sectors, top companies in a sector, emerging markets, etc...

I think I've said this before but it's worth repeating. Please be careful if you choose to use leveraged ETFs.

ETFs can provide diversification and reduction of risk compared to stock picking if one is careful. However, typical due diligence is in order. How's the liquidity, etc...?

Best of luck with your investing / trading! Cheers.

P.S. This investments course from MIT Open Courseware is quite good - http://ocw.mit.edu/courses/sloan-school-of-management/15-433-investments-spring-2003/lecture-notes/ .

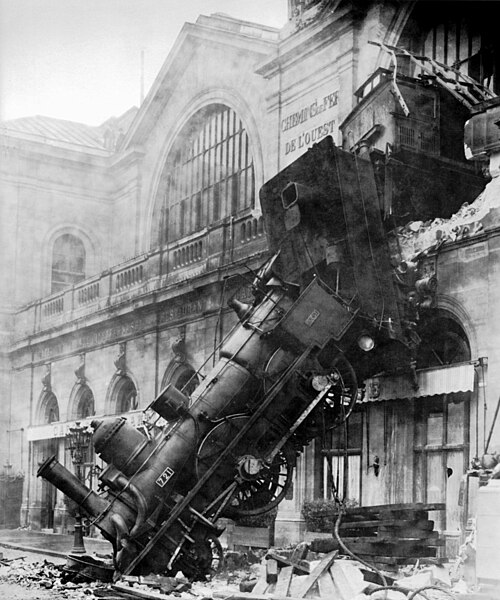

(Image credit: http://en.wikipedia.org/wiki/File:Train_wreck_at_Montparnasse_1895.jpg )

“Luck is what happens when preparation meets opportunity.” - Seneca

Disclaimer: Please only use this information with a grain of salt and at your own risk / for educational purposes. I am not an investment advisor so please seek professional help if that's what you're looking for.

No comments:

Post a Comment